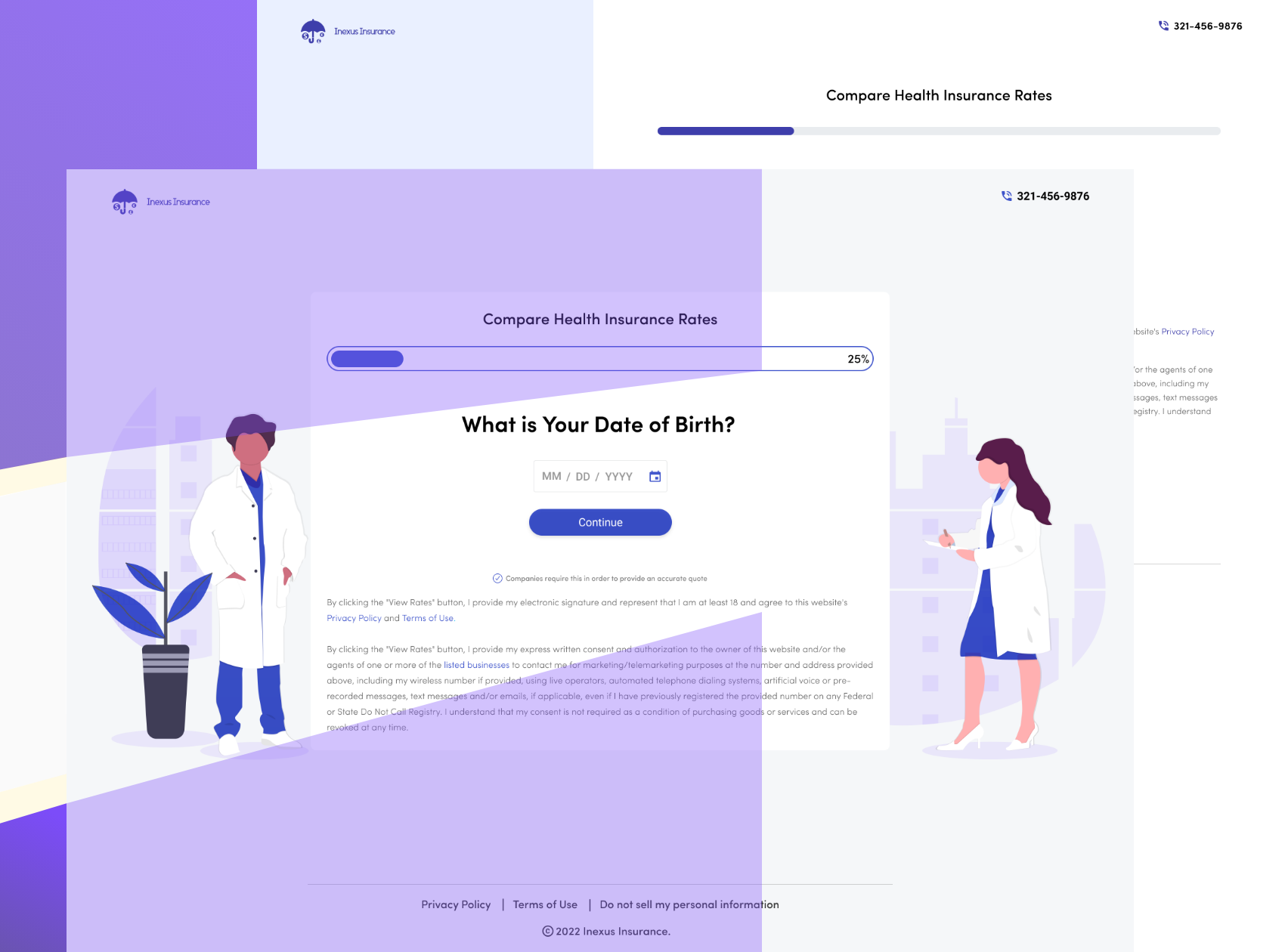

Insurance

Infinire insurance practice was built from the ground up for technology innovation and business transformation. We gathered insurance industry thought leaders, business consultants, and senior technologists from industry-leading insurance firms, consultancies, and solutions providers around the world. And while our expertise is diverse, we all have one trait in common: the DNA for disruption.

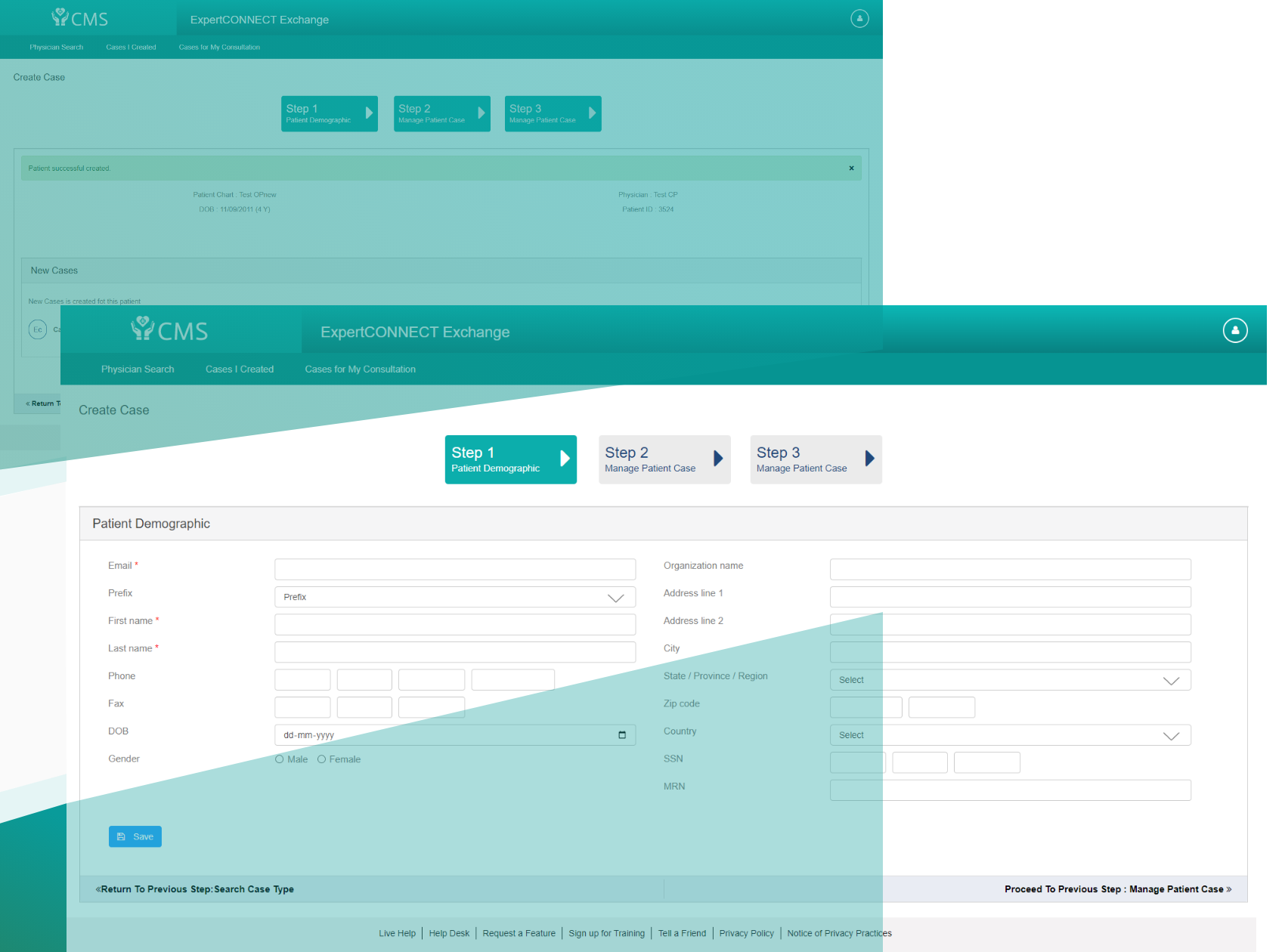

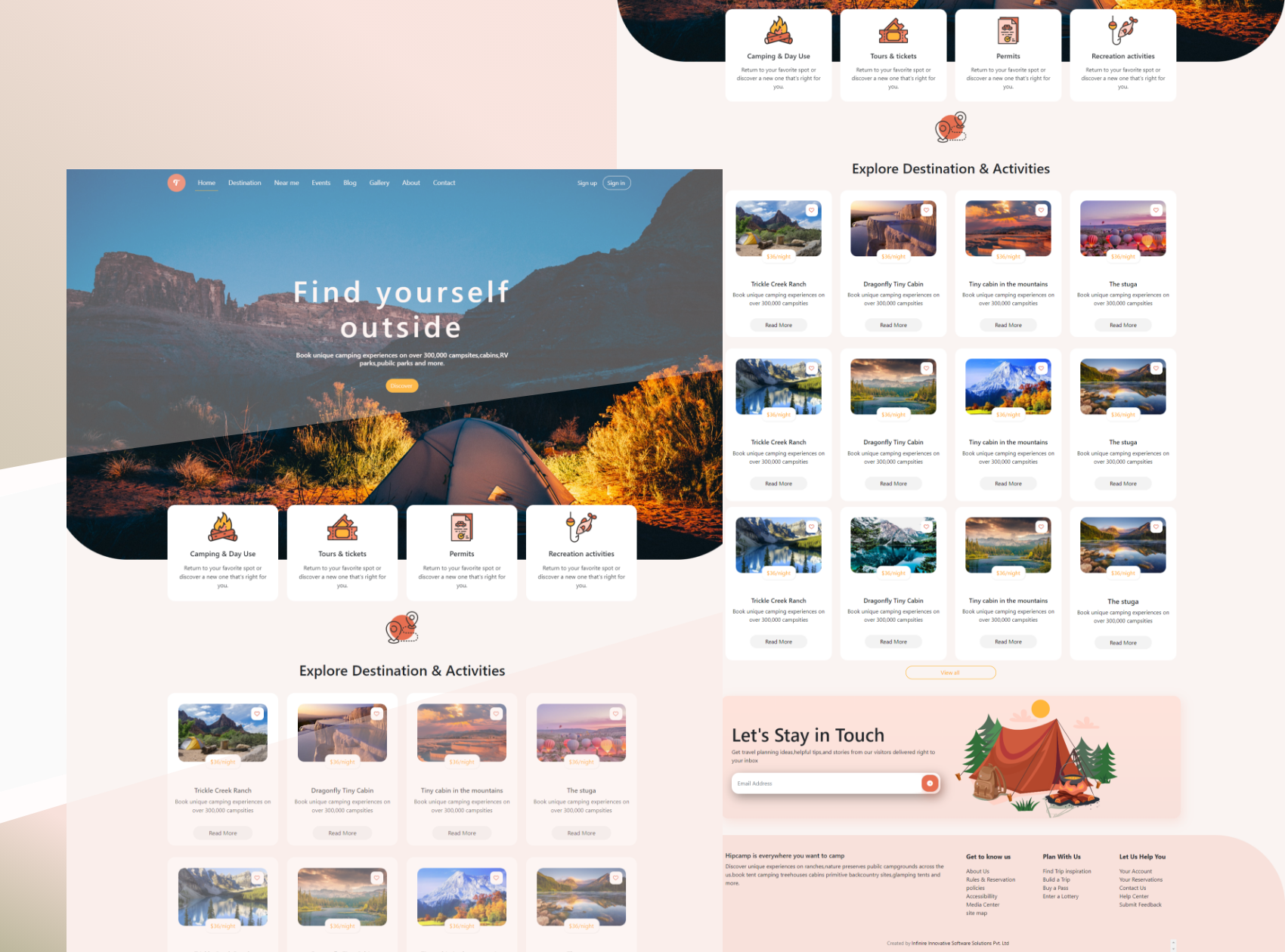

Digital technology solutions dramatically increase the success of your digital transformation. Whether it is about developing complete new solutions or scaling existing processes and staff worldwide, Virtusa helps you reach your goals in today's most complex and fast moving use cases.

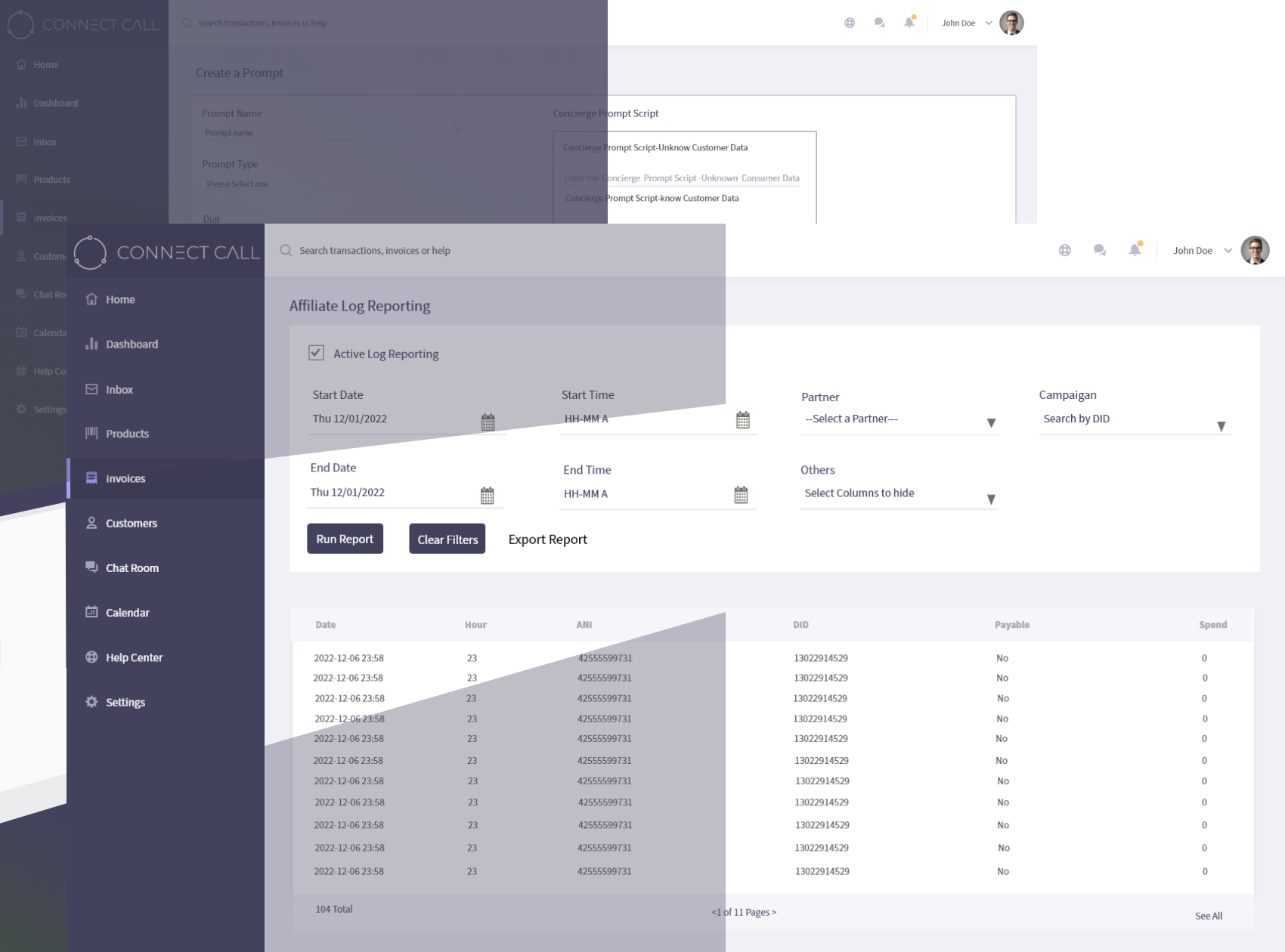

Harness conversation AI to enrich customer and employee experience across touchpoints with virtusa.

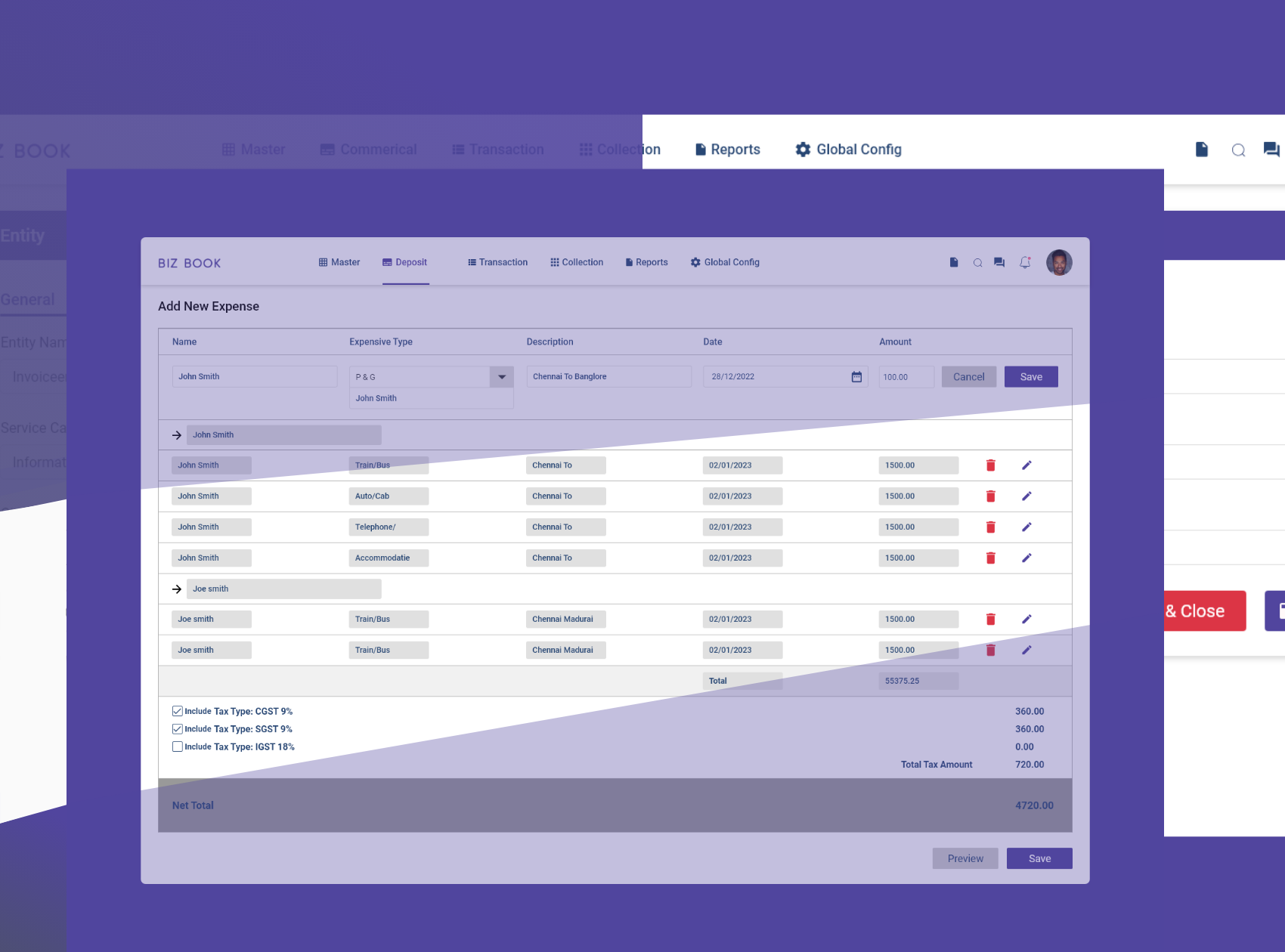

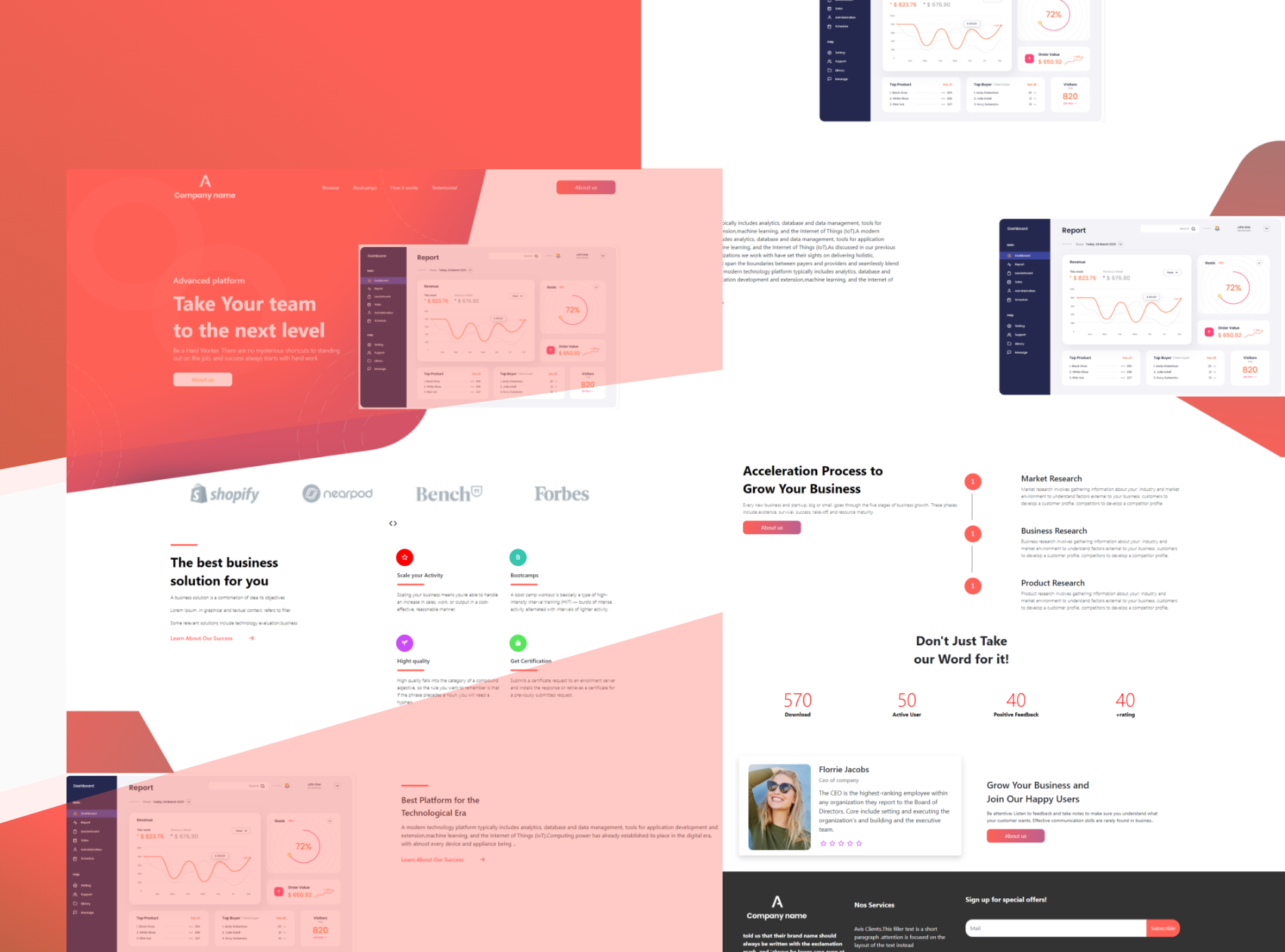

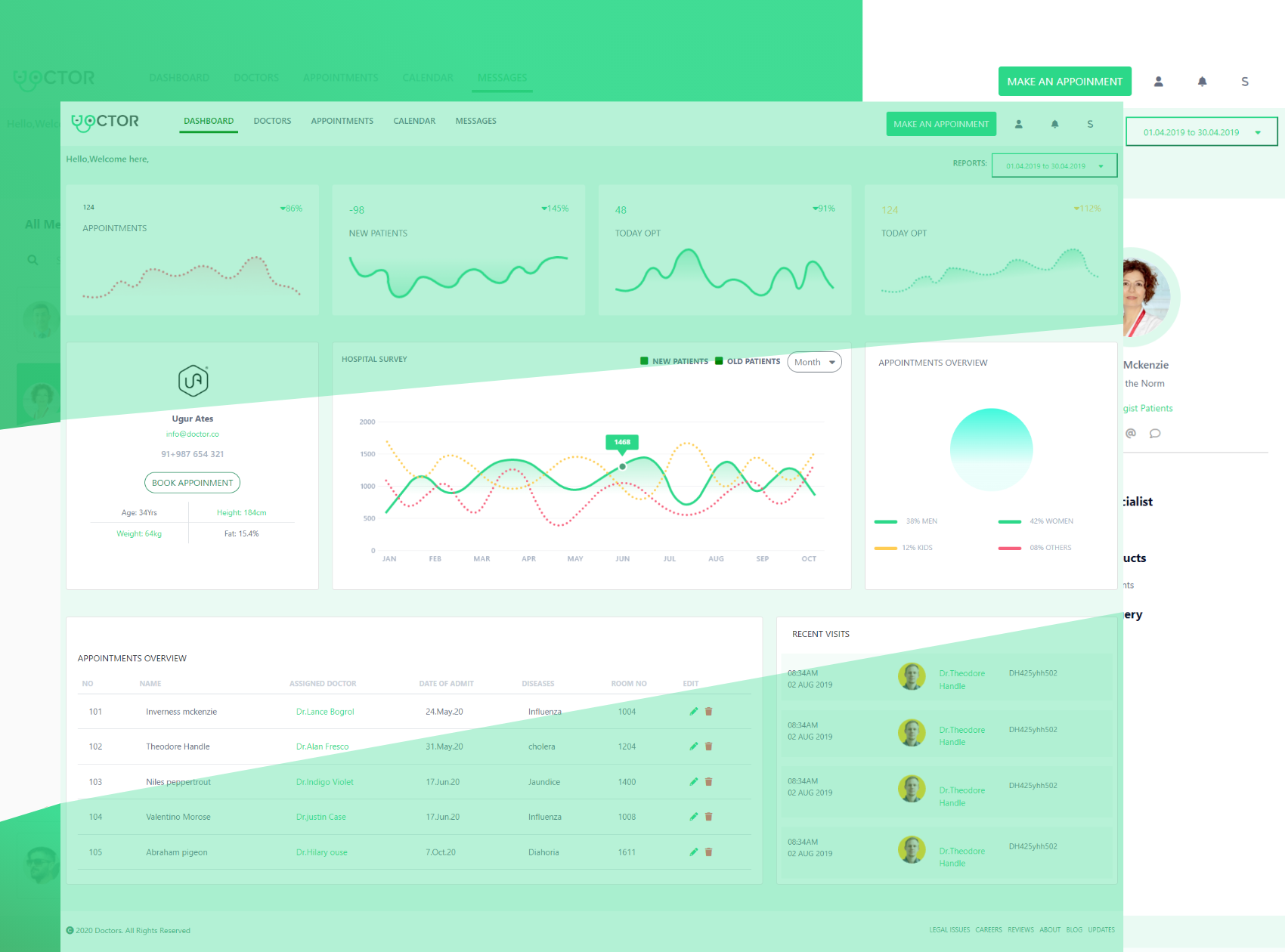

A platform for insurers to derive business insights using dashboard and models that slice,dice and simulate data today's most complex and fast

The solution capitallize on AI and analytics to improve straight through processing and reduce time-to-market for new products

We enable Purposeful and personal digital interactions that drive real customer engagement and profits complex and fast